Capital Attraction

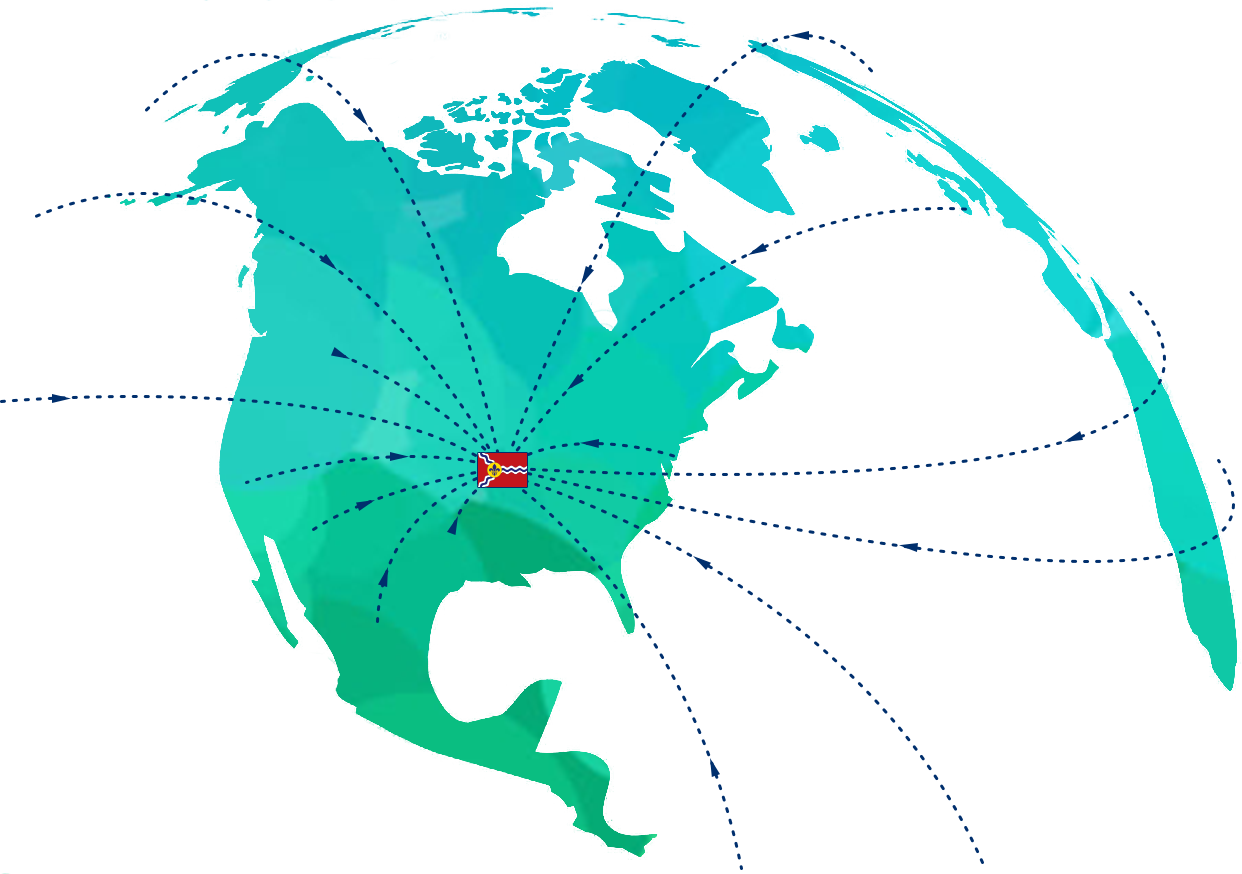

BioSTL has grown seed and venture capital accessible to startups in the St. Louis region by catalyzing the creation of new local funds and attracting new investor groups both nationally and internationally. BioSTL also connects startups to potential investors and coaches entrepreneurs to be effective fundraisers. Coaching includes honing these skills through grant writing and mock panel presentation training to help develop competitive applications for federal commercialization grants and other non-dilutive funding.